Weather Radar Market is Projected To Grow Significantly Due To Rising Application in Meteorology

The Weather Radar Market is estimated to be valued at US$ 117.29 million in 2023 and is expected to exhibit a CAGR of 19.9% over the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

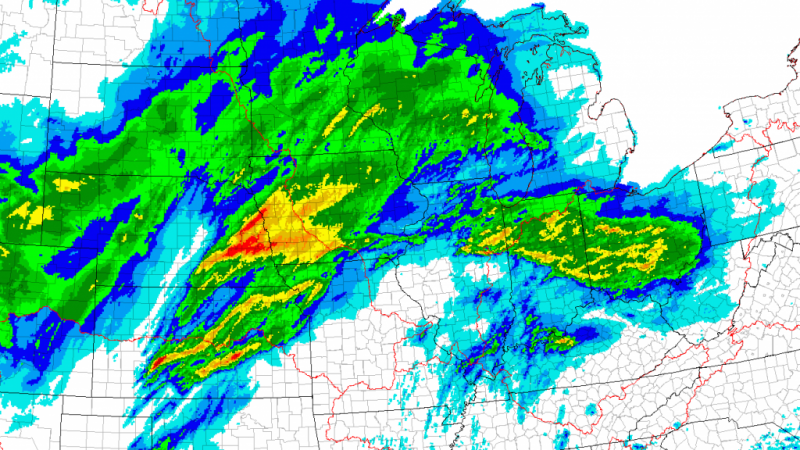

Weather radar, also known as weather surveillance radar (WSR), is a type of radar used to locate precipitation, calculate its motion, and estimate its type (rain, snow etc.). Weather radars emit radio waves that travel through the atmosphere. The radio waves bounce off objects in the air like raindrops, snowflakes, and hail. The radar system detects these radio wave echoes and uses them to estimate the location, intensity, and movement of precipitation.

Market key trends:

One of the key drivers of the weather radar market is the rising application of weather radars in meteorology. Weather radars allow meteorologists to detect storms, track their movements, and issue warnings. The high-resolution images provided by Doppler weather radars help in identifying features within storms like wind shear, tornadoes, hail formation etc. This helps meteorologists to issue more accurate and granular warnings. With climate change leading to more extreme weather, the demand for weather radar systems from meteorology organizations is increasing globally to strengthen weather monitoring infrastructure. The ongoing technological advancements focused on improving accuracy, coverage and affordability of weather radar systems will further support the growth of this market over the coming years.

Porter’s Analysis

Threat of new entrants: The threat of new entrants in the weather radar market is low as there are high capital requirements for R&D and manufacturing. Additionally, existing players have strong brand loyalty.

Bargaining power of buyers: The bargaining power of buyers is moderate due to the presence of multiple vendors providing weather radar systems. However, switching costs make buyers dependent on certain vendors.

Bargaining power of suppliers: The bargaining power of suppliers is low owing to the availability of substitute components. Suppliers do not have control over pricing.

Threat of new substitutes: The threat of new substitutes is low as weather radar systems have specialized applications that cannot be easily substituted.

Competitive rivalry: Intense due to the presence of established players competing on product quality, features, and pricing.

SWOT Analysis

Strength: Weather radars provide accurate weather monitoring and forecasting capabilities. Advancements in technology have improved resolution and coverage area.

Weakness: High installation and maintenance costs act as barriers. Dependency on weather conditions can affect accuracy.

Opportunity: Growing need for precision agriculture and weather monitoring in aviation and marine industries offers lucrative opportunities. Increasing adoption in developing regions as well.

Threats: Economic slowdowns can decrease infrastructure spending. Stiff competition from alternative monitoring technologies.

Key Takeaways

The Global Weather Radar Market size was valued at US$ 117.29 million in 2023.

is expected to witness high growth, exhibiting CAGR of 19.9% over the forecast period, due to increasing demand for precise prediction of adverse weather conditions. North America dominates the weather radar market currently due to strong government investments and early adoption of advanced technologies. The Asia Pacific region is expected to offer lucrative opportunities with the growing agriculture industry in China and India demanding timely weather updates.

Key players operating in the weather radar market are Furuno Electric Co., Ltd, EWR Weather Radar, Honeywell International Inc, Selex ES Gmbh, Beijing Metstar Radar Corporation Ltd., Vaisala, Garmin International Ltd, Glarun Technology Co, Ltd., AERODATA, Inc, and Anhui Sun Create Electronics Co. Ltd. Continuous innovation is helping companies improve features like dual polarization, mobile platforms, and compact systems. Strategic partnerships remain important for sourcing key components and global expansion.