Global Epitaxial Wafer Market Is Estimated To Witness High Growth Owing To Increasing Demand for Advanced Semiconductor Technologies

The global Epitaxial Wafer market is estimated to be valued at USD 2,778 million in 2022 and is expected to exhibit a CAGR of 12.9% over the forecast period 2022 to 2030, as highlighted in a new report published by Coherent Market Insights.

A) Market Overview:

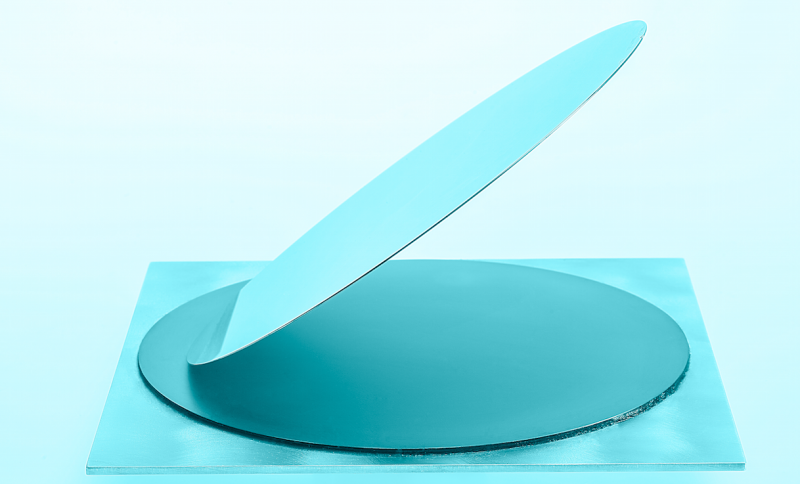

Epitaxial wafers refer to thin layers of single-crystal semiconductor material that are deposited on the surface of a substrate wafer. These wafers play a crucial role in the production of advanced semiconductor devices, such as transistors, diodes, LEDs, and ICs. The epitaxial process enhances the electrical and optical properties of the wafers, thereby improving the performance of the final semiconductor devices.

The increasing demand for advanced semiconductor technologies, driven by rapid technological advancements in various industries such as electronics, automotive, and telecommunications, is fueling the growth of the global epitaxial wafer market. These wafers are extensively used in the fabrication of high-performance electronic components, which offer advantages such as smaller form factors, improved power efficiency, and enhanced device performance.

B) Market Key Trends:

One key trend driving the global epitaxial wafer market is the rise in demand for compound semiconductors. Compound semiconductors, such as gallium arsenide (GaAs), indium phosphide (InP), and silicon carbide (SiC), offer superior electrical properties compared to traditional silicon-based semiconductors. The growing need for higher bandwidth, faster data transmission, and higher power efficiency in various applications is propelling the adoption of compound semiconductors. Epitaxial wafers play a crucial role in the production of compound semiconductors, thereby driving the demand for epitaxial wafer technologies.

For instance, GaAs-based epitaxial wafers find wide applications in the telecommunications industry for the development of high-frequency electronic devices, such as wireless transmitters and receivers. Similarly, SiC-based epitaxial wafers are widely used in power electronics applications, offering advantages such as higher breakdown voltage, lower power losses, and faster switching speeds.

C) PEST Analysis:

Political: The political environment plays a crucial role in the growth of the epitaxial wafer market. Government regulations, policies, and trade restrictions in different regions can significantly impact the import and export of epitaxial wafer materials and technologies.

Economic: Economic factors, such as global GDP growth, inflation rates, consumer spending patterns, and investment in research and development activities, can influence the demand and supply dynamics of the epitaxial wafer market.

Social: The increasing adoption of advanced electronic devices and technologies in various sectors, such as healthcare, automotive, and telecommunications, is driving the demand for epitaxial wafers. Changing consumer preferences towards smaller, faster, and more efficient electronic devices are also shaping the market trends.

Technological: Rapid technological advancements in semiconductor manufacturing processes and the development of innovative epitaxial processes, such as molecular beam epitaxy (MBE) and metalorganic chemical vapor deposition (MOCVD), are driving the growth of the epitaxial wafer market. Advancements in materials science and nanotechnology are also fueling the market growth.

D) Key Takeaways:

- The global Epitaxial Wafer Market is expected to witness high growth, exhibiting a CAGR of 12.9% over the forecast period, due to increasing demand for advanced semiconductor technologies.

- The Asia-Pacific region is expected to be the fastest-growing and dominating region in the global epitaxial wafer market. The region is home to major semiconductor manufacturing hubs, such as China, Japan, South Korea, and Taiwan, which are driving the demand for epitaxial wafers.

- Key players operating in the global epitaxial wafer market include EpiWorks Inc., Global Wafers Japan Co. Ltd., Nichia Corporation, Showa Denko K.K., Siltronic AG, Desert Silicon Inc., Electronics and Materials Corporation Ltd., Intelligent Epitaxy Technology Inc., IQE plc., Jenoptic AG, MOSPEC Semiconductor Corporation, Norstel AB, Ommic S.A., Silicon Valley Microelectronics Inc., SVT Associates Inc., Universal Wafer Inc., Wafer Works Corporation, Xiamen Powerway Advanced Materials Co. Ltd., and Visual Photonics Epitaxy Co. Ltd.

In conclusion, the global epitaxial wafer market is poised to witness significant growth due to the increasing demand for advanced semiconductor technologies. The rise in demand for compound semiconductors and the continuous advancements in epitaxial processes are expected to drive the market growth. The Asia-Pacific region is anticipated to dominate the market, fueled by major semiconductor manufacturing hubs. Key players in the market are investing in research and development activities to develop innovative epitaxial wafer technologies to meet the evolving industry requirements.

The global Epitaxial Wafer market is estimated to be valued at USD 2,778 million in 2022 and is expected to exhibit a CAGR of 12.9% over the forecast period 2022 to 2030, as highlighted in a new report published by Coherent Market Insights.

A) Market Overview:

Epitaxial wafers refer to thin layers of single-crystal semiconductor material that are deposited on the surface of a substrate wafer. These wafers play a crucial role in the production of advanced semiconductor devices, such as transistors, diodes, LEDs, and ICs. The epitaxial process enhances the electrical and optical properties of the wafers, thereby improving the performance of the final semiconductor devices.

The increasing demand for advanced semiconductor technologies, driven by rapid technological advancements in various industries such as electronics, automotive, and telecommunications, is fueling the growth of the global epitaxial wafer market. These wafers are extensively used in the fabrication of high-performance electronic components, which offer advantages such as smaller form factors, improved power efficiency, and enhanced device performance.

B) Market Key Trends:

One key trend driving the global epitaxial wafer market is the rise in demand for compound semiconductors. Compound semiconductors, such as gallium arsenide (GaAs), indium phosphide (InP), and silicon carbide (SiC), offer superior electrical properties compared to traditional silicon-based semiconductors. The growing need for higher bandwidth, faster data transmission, and higher power efficiency in various applications is propelling the adoption of compound semiconductors. Epitaxial wafers play a crucial role in the production of compound semiconductors, thereby driving the demand for epitaxial wafer technologies.

For instance, GaAs-based epitaxial wafers find wide applications in the telecommunications industry for the development of high-frequency electronic devices, such as wireless transmitters and receivers. Similarly, SiC-based epitaxial wafers are widely used in power electronics applications, offering advantages such as higher breakdown voltage, lower power losses, and faster switching speeds.

C) PEST Analysis:

Political: The political environment plays a crucial role in the growth of the epitaxial wafer market. Government regulations, policies, and trade restrictions in different regions can significantly impact the import and export of epitaxial wafer materials and technologies.

Economic: Economic factors, such as global GDP growth, inflation rates, consumer spending patterns, and investment in research and development activities, can influence the demand and supply dynamics of the epitaxial wafer market.

Social: The increasing adoption of advanced electronic devices and technologies in various sectors, such as healthcare, automotive, and telecommunications, is driving the demand for epitaxial wafers. Changing consumer preferences towards smaller, faster, and more efficient electronic devices are also shaping the market trends.

Technological: Rapid technological advancements in semiconductor manufacturing processes and the development of innovative epitaxial processes, such as molecular beam epitaxy (MBE) and metalorganic chemical vapor deposition (MOCVD), are driving the growth of the epitaxial wafer market. Advancements in materials science and nanotechnology are also fueling the market growth.

D) Key Takeaways:

- The global Epitaxial Wafer Market is expected to witness high growth, exhibiting a CAGR of 12.9% over the forecast period, due to increasing demand for advanced semiconductor technologies.

- The Asia-Pacific region is expected to be the fastest-growing and dominating region in the global epitaxial wafer market. The region is home to major semiconductor manufacturing hubs, such as China, Japan, South Korea, and Taiwan, which are driving the demand for epitaxial wafers.

- Key players operating in the global epitaxial wafer market include EpiWorks Inc., Global Wafers Japan Co. Ltd., Nichia Corporation, Showa Denko K.K., Siltronic AG, Desert Silicon Inc., Electronics and Materials Corporation Ltd., Intelligent Epitaxy Technology Inc., IQE plc., Jenoptic AG, MOSPEC Semiconductor Corporation, Norstel AB, Ommic S.A., Silicon Valley Microelectronics Inc., SVT Associates Inc., Universal Wafer Inc., Wafer Works Corporation, Xiamen Powerway Advanced Materials Co. Ltd., and Visual Photonics Epitaxy Co. Ltd.

In conclusion, the global epitaxial wafer market is poised to witness significant growth due to the increasing demand for advanced semiconductor technologies. The rise in demand for compound semiconductors and the continuous advancements in epitaxial processes are expected to drive the market growth. The Asia-Pacific region is anticipated to dominate the market, fueled by major semiconductor manufacturing hubs. Key players in the market are investing in research and development activities to develop innovative epitaxial wafer technologies to meet the evolving industry requirements.