An Overview of the Global Carbon Credit Market

The global carbon credit market has emerged as a key instrument in the fight against climate change. With the rising concern over greenhouse gas emissions and their impact on the environment, governments and organizations worldwide are increasingly turning to carbon credits as a means to reduce their carbon footprint.

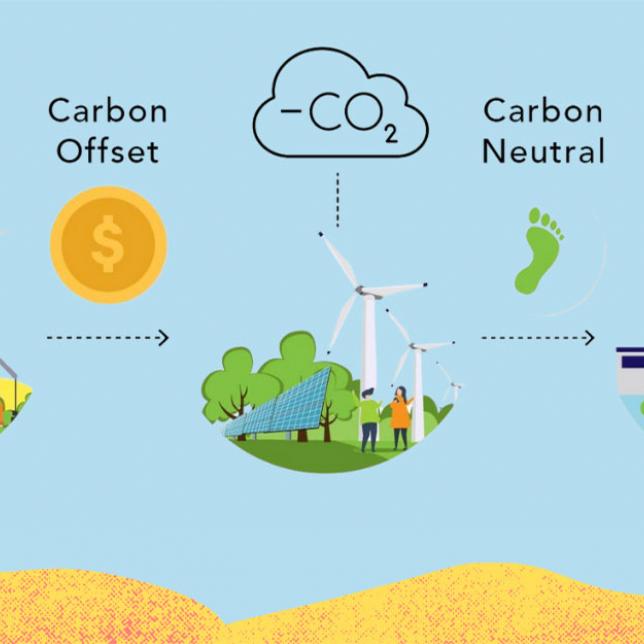

Carbon credits operate on the principle of emissions trading. Companies or countries that emit greenhouse gases below their allocated limit can earn carbon credits, which they can sell to entities that exceed their emission limits. This system creates an economic incentive for emission reduction and fosters the adoption of cleaner technologies and sustainable practices.

Europe held a dominant position in the Global Carbon Credit Market in 2022, accounting for 51.2% share in terms of value, followed by North America and Asia Pacific. Europe is expected to account for the largest market share during the forecast period.

The market's growth has been remarkable, driven by the implementation of carbon pricing mechanisms, international climate agreements, and corporate social responsibility initiatives. Additionally, the surge in demand for sustainable products and services has further propelled the global carbon credit market.

Various types of carbon credits exist, including certified emission reduction (CER) credits, verified carbon standard (VCS) credits, and nature-based credits. These credits represent emission reduction projects in renewable energy, energy efficiency, afforestation, and reforestation, among others.

While the Global Carbon Credit Market offers promising opportunities for emission reduction, it also faces challenges. Ensuring the integrity and credibility of carbon credits requires robust verification mechanisms and standardization of methodologies. Addressing these challenges will be crucial for the market's continued growth and effectiveness in combatting climate change.