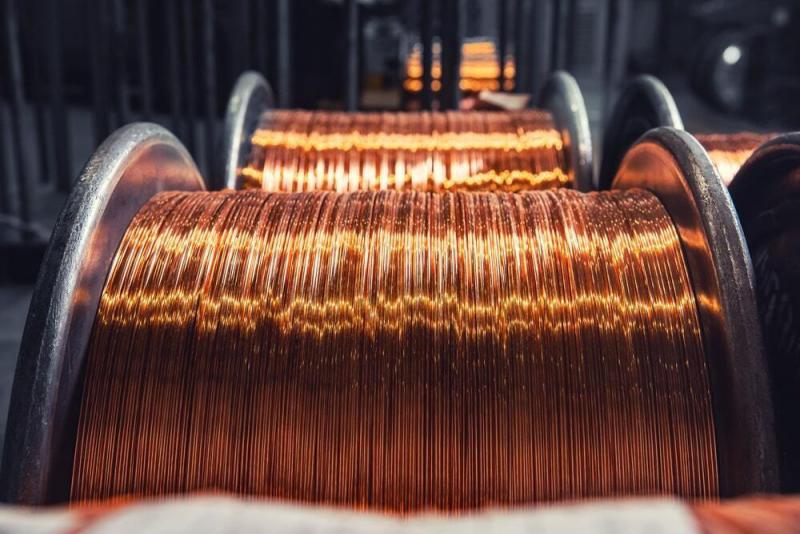

Copper clad steel wire (CCSW), also known as copper-coated steel wire or copper-bonded steel wire, is made of a high-carbon steel core that is plated or clad with a layer of copper. It is widely used in applications that require electrical conductivity and strength, such as grounding and bonding, hardware cladding, electronics and electrical components. CCSW offers the strength of steel with the conductivity and anti-corrosion properties of copper at a lower cost than solid copper wire.

The global U.S. Copper Clad Steel Wire Market is estimated to be valued at US$ 2812.51 Mn in 2023 and is expected to exhibit a CAGR of 2.4% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

One of the key drivers for the high growth of the U.S. copper clad steel wire market is the rise in construction activities in the country. Copper clad steel wires finds major application in grounding and bonding at construction sites due to its strength and electrical conductivity properties. Increasing residential and commercial construction projects are thus augmenting the demand for CCSW. According to United States Census Bureau, the seasonally adjusted annual rate of housing starts in December 2021 rose to 1,702,000. This rise in construction activities is slated to drive the copper clad steel wire market over the forecast period. Additionally, favorable government policies and initiatives such as tax cuts and infrastructure spending are also fueling growth in the construction sector, thereby boosting the copper clad steel wire market in the country.

SWOT Analysis:

Strength: The U.S. copper clad steel wire market benefits from strong domestic demand in various end-use industries. Copper clad steel wire offers high strength and corrosion resistance making it suitable for applications requiring these properties. Manufacturers in the U.S. have advanced manufacturing facilities and process controls ensuring product quality.

Weakness: Fluctuations in raw material prices can negatively impact production costs for copper clad steel wire manufacturers. Import of cheaper alternatives from other countries also increases competitive pressure.

Opportunity: Growing infrastructure development and construction spending is spurring copper wire usage. Renewable energy sector expansion presents opportunities for copper wire adoption in applications such as solar panel wiring. The automotive industry's transition to electric mobility will bolster copper wire consumption.

Threats: stringent environmental regulations around copper and steel manufacturing may raise compliance costs. A global economic slowdown can reduce spending on infrastructure and industrial projects hurting market demand.

Key Takeaways:

The Global U.S. Copper Clad Steel Wire Market Size is expected to witness high growth over the forecast period. Being the largest consumer market for copper wires, the U.S. dominates North America. Major project announcements in utility, telecom and construction sectors signal strong demand prospects.

Regional analysis:

The Western region accounts for the largest share of the U.S copper clad steel wire market currently due to solid infrastructure spending. Initiatives to modernize the power grid and develop renewable energy have spurred copper wire consumption. The Midwestern region is growing at a rapid pace led by the states of Illinois, Indiana and Missouri where major investments are underway in transportation and energy projects.

Key players:

Key players operating in the U.S. copper clad steel wire market are Copperhead Industries, LLC, American Wire Group, Inc., Nehring Electrical Works Company, Kris-Tech Wire, MWS Wire Industries Inc., AFL, LEONI Wire Inc., Fisk Alloy Inc., and Elecref Industries Inc. Copperhead Industries is one of the leading manufacturers of copper clad steel wire in North America.

Explore more information on this topic, Please visit -