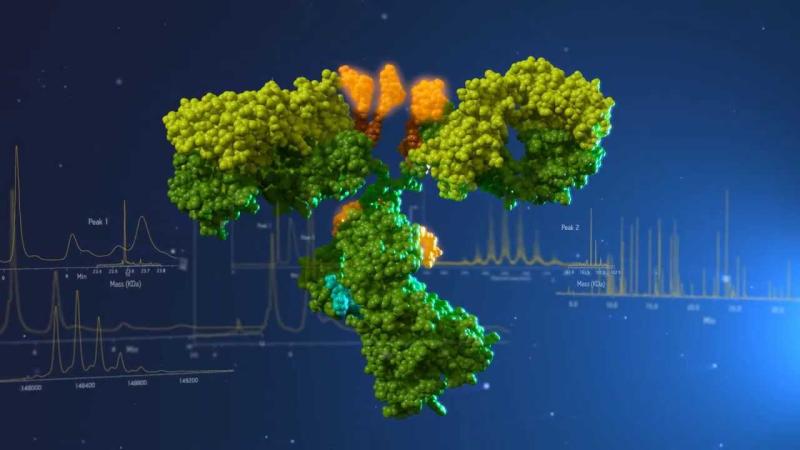

The Antibody Drug Conjugates (ADC) industry is witnessing significant innovation that is reshaping targeted cancer therapies globally. As advanced drug delivery systems gain prominence, the market dynamics continue to evolve, driven by breakthroughs in ADC design and efficacy. This blog presents a comprehensive analysis of the Antibody Drug Conjugates market size, key drivers, and strategic growth insights, supported by recent data from 2024 and 2025.

Antibody Drug Conjugates Market is estimated to be valued at USD 7.01 Bn in 2025 and is expected to reach USD 17.76 Bn in 2032, exhibiting a compound annual growth rate (CAGR) of 14.2% from 2025 to 2032.

Antibody Drug Conjugates Market Demand reflects expanding applications of ADCs in oncology and other therapeutic areas, fueled by technological advancements in bioconjugation and payload optimization. Current market research highlights increasing investments by pharmaceutical companies in ADC pipeline development, which underpins the positive market forecast.

Key Takeaways

- Dominating Region: North America leads the Antibody Drug Conjugates market share in 2025, owing to strong R&D infrastructure and regulatory support; for instance, the FDA’s approval of multiple ADC therapies accelerated market revenue.

- Fastest Growing Region: Asia Pacific shows the fastest market growth driven by rising cancer prevalence and increased healthcare expenditure in countries like China and India.

- By Payload Type: Microtubule inhibitors dominate this segment, with monomethyl auristatin E (MMAE) being the fastest-growing payload type, exemplified by several new ADCs launched in 2024.

- By Cancer Indication: Hematological cancers capture the largest market size, while solid tumors represent the fastest-growing segment, supported by novel ADC approvals targeting breast and lung cancers in 2025.

- By Application: Therapeutic oncology remains the dominant application, with diagnostic and research applications showing rapid adoption due to advancements in precision medicine technologies.

Market Key Trends

One pivotal market trend shaping the Antibody Drug Conjugates landscape is the evolution of novel linker technologies enhancing stability and targeted payload release. In 2024, a groundbreaking cleavable linker was incorporated into a next-generation ADC, improving therapeutic index and minimizing off-target effects. This innovation was pivotal in regulatory approvals facilitating safer and more effective treatment options. Moreover, increasing collaborations between biotech firms and contract development organizations (CDMOs) have streamlined ADC manufacturing processes, as evidenced by several partnerships formed in early 2025. This synergy addresses market challenges related to scalability and cost, reinforcing market growth strategies.

Key Players

Prominent market players in the Antibody Drug Conjugates market include AstraZeneca PLC, Daiichi Sankyo Company, Limited, Novasep, ADC Therapeutics SA, Alentis Therapeutics AG, and F. Hoffmann-La Roche. These market companies have adopted aggressive growth strategies, such as product pipeline expansion, strategic partnerships, and technology licensing. For example, in 2024, Daiichi Sankyo entered into a strategic collaboration with a leading biotech company to expand its ADC library, which is projected to boost future market revenue. AstraZeneca ramped up clinical trials globally with enhanced focus on combination therapies leveraging ADCs, which led to accelerated approvals in 2025. Additionally, Novasep’s investment in process innovation led to more efficient conjugation technologies, reducing manufacturing costs and strengthening market position.

FAQs

1. Who are the dominant players in the Antibody Drug Conjugates market?

Major Antibody Drug Conjugates market players include AstraZeneca PLC, Daiichi Sankyo Company, Limited, Novasep, ADC Therapeutics SA, Alentis Therapeutics AG, and F. Hoffmann-La Roche. These companies focus on innovation, collaborations, and pipeline diversification to enhance their competitive positioning.

2. What will be the size of the Antibody Drug Conjugates market in the coming years?

The Antibody Drug Conjugates market size is expected to reach approximately USD 19.5 billion by 2032, growing at a CAGR of 14% between 2025 and 2032, driven by expansion in oncology applications and improved therapeutic designs.

3. Which end-user segment has the largest growth opportunity in the Antibody Drug Conjugates market?

Therapeutic oncology, specifically targeting hematological and solid tumors, holds the largest growth opportunity due to the rising incidence of cancers and innovation in ADC drug design and payloads.

4. How will market development trends evolve over the next five years in the Antibody Drug Conjugates market?

Market trends will focus increasingly on advanced linker and payload technologies, integration of AI in drug discovery, and expansion of ADCs beyond oncology, supporting sustained business growth and market revenue.

5. What is the nature of the competitive landscape and challenges in the Antibody Drug Conjugates market?

The competitive landscape is marked by intensive R&D and collaborations, with challenges including complex manufacturing processes and regulatory hurdles that companies are addressing through innovation and strategic partnerships.

6. What go-to-market strategies are commonly adopted in the Antibody Drug Conjugates market?

Key go-to-market strategies involve portfolio diversification, leveraging partnerships with contract development organizations, and expanding clinical trial footprints globally to accelerate product approvals and accessibility.

Get this Report in Japanese Language: 抗体薬物複合体市場

Get this Report in Korean Language: 항체 약물 접합체 시장

Read More Articles Related to this Industry

Health Benefits of Bay Leaves: A Natural Remedy for Wellness

About Author:

Money Singh is a seasoned content writer with over four years of experience in the market research sector. Her expertise spans various industries, including food and beverages, biotechnology, chemical and materials, defense and aerospace, consumer goods, etc. (https://www.linkedin.com/in/money-singh-590844163)