Technical Insights into EVA: Composition, Polymerization Processes, and Performance Characteristics

Technical Properties and Production Processes of Ethylene Vinyl Acetate

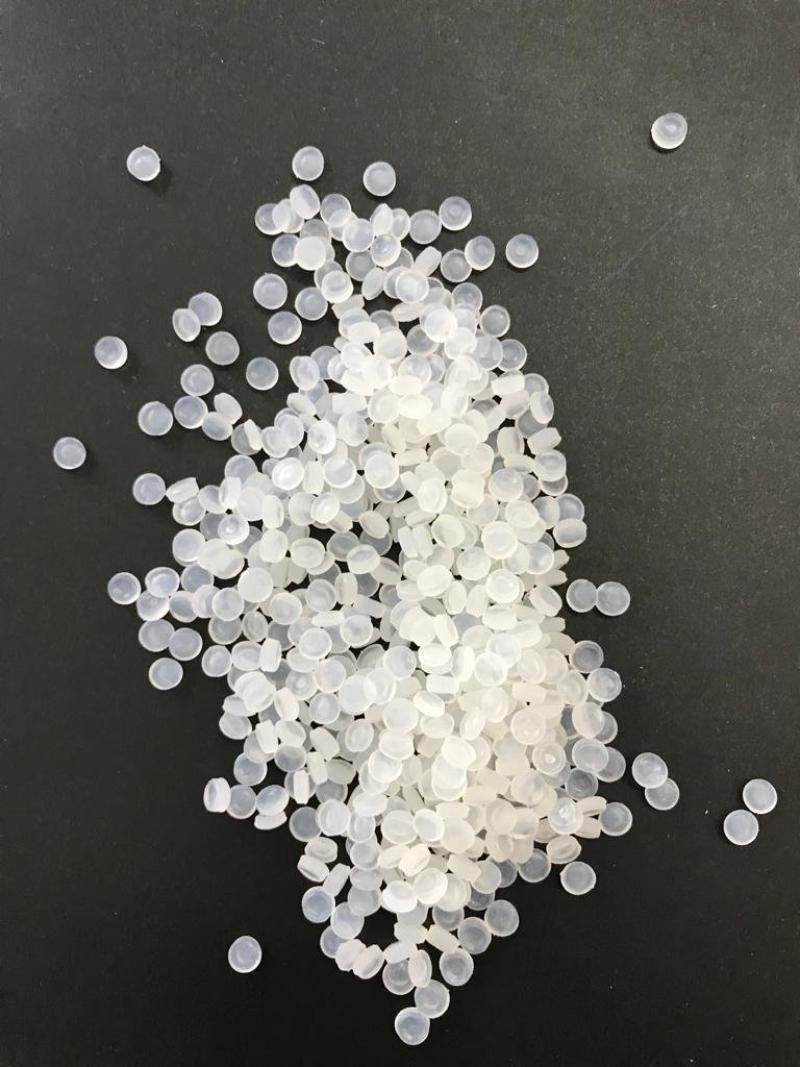

Ethylene Vinyl Acetate (EVA) is a copolymer of ethylene and vinyl acetate, renowned for its flexibility, transparency, and toughness. The unique balance between crystalline and amorphous phases is achieved by varying vinyl acetate content—typically between 10% and 40%—unlocking a range of hardness and elasticity profiles.

Production commonly utilizes high-pressure tubular reactors or solution-phase processes with free radical initiators, while specialty grades often rely on controlled Ziegler–Natta or metallocene catalysts to ensure consistent molecular weight distribution. Advances in process optimization deliver improved melt flow and reduced residual monomer levels, addressing environmental and safety queries about emissions. Tailored polymerization conditions help manufacturers meet stringent quality specifications for food-contact applications and medical-grade foams.

Understanding these technical parameters answers industry questions about why certain EVA grades perform better in high-impact sports equipment compared to those used in flexible photovoltaic encapsulants. As the polymer chains incorporate vinyl acetate randomly, suppliers can engineer EVA sheets with superior UV stability, chemical resistance, and acoustic dampening—attributes sought in automotive seals and construction membranes. This depth of information addresses searches for “how is EVA made” and “what are the chemical properties of ethylene vinyl acetate” without posing direct questions in the text.

Key Applications Driving Ethylene Vinyl Acetate Demand Globally

The versatility of EVA underpins a wide array of applications that fuel global demand. In the packaging sector, EVA films and hot melt adhesives offer excellent seal strength and clarity, meeting consumer expectations for shelf appeal and freshness. Footwear manufacturers rely on EVA foam for midsoles and insoles, where cushioning, shock absorption, and lightweight performance are paramount. Athletic footwear brands leverage the polymer’s resilience to enhance energy return under dynamic loads. In the renewable energy industry, EVA encapsulants safeguard photovoltaic cells against moisture ingress and mechanical stress, resulting in long-lasting solar panels.

Medical device producers adopt biocompatible EVA grades for tubing, blood bags, and drug delivery systems, trusting the polymer’s low extractables and sterilization stability. Ethylene Vinyl Acetate Automotive OEMs utilize EVA blends in window profiles, weatherstripping, and interior trims, addressing noise reduction and heat insulation requirements. Even stationery and sports goods leverage EVA sheets for protective cases and play mats. This broad spectrum of uses responds to common informational interests in “applications of EVA” and “uses of ethylene vinyl acetate” by outlining specific end-use markets and performance drivers that guide purchasing decisions.

Emerging Market Trends and Growth Opportunities in EVA Industry

Several emerging trends are reshaping the EVA landscape, presenting compelling growth opportunities and investment outlooks. Sustainability concerns have spurred development of bio-based EVA derived from renewable ethylene feedstocks, offering lower carbon footprints without compromising performance. Recycling initiatives are gaining momentum, with innovative depolymerization processes enabling closed-loop recovery of vinyl acetate monomers. Product developers are also exploring specialty EVA copolymers with enhanced flame retardancy, self-healing properties, and antimicrobial additives to meet evolving regulatory requirements and end-user preferences.

On the commercial front, demand for electric vehicles and lightweight battery casings is driving research into high-performance EVA foams that balance thermal management with mechanical resilience. Price volatility of raw materials has prompted vertical integration strategies among major producers to secure ethylene and acetic acid supplies. Meanwhile, manufacturers are seeking to differentiate through value-added services such as customized color matching, just-in-time inventory, and technical troubleshooting. For procurement teams and product engineers, understanding these trajectories is essential when navigating supplier selection and negotiating long-term supply agreements. This section caters to searches around “EVA market trends,” “growth opportunity in vinyl acetate applications,” and “investment outlook for polymer industry.”

Regional Insights and Competitive Landscape Overview

Asia Pacific continues to dominate production and consumption of EVA, underpinned by a robust plastics conversion base in China, India, and Southeast Asia. Low-cost manufacturing hubs and expanding end-use industries—particularly footwear and electronics—have cemented the region’s leadership in exports.

In North America and Europe, stringent environmental regulations and demand for high-purity grades have steered capacity additions toward specialty EVA plants, often co-located with renewable energy operations. Strategic alliances and joint ventures are on the rise, enabling technology transfers for novel catalyst systems and scale-up of next-generation copolymer blends. Leading chemical enterprises and mid-tier producers alike are investing in downstream compounding facilities to offer pre-filled masterbatches, UV-stabilized formulations, and performance-enhanced EVA compounds. Competitive differentiation hinges on rapid sample turnaround, rigorous quality assurance certifications, and global logistics networks. Market participants tracking global supply chains find that Asia export volumes and Western product innovation cycles both influence regional pricing trends. Insights into production efficiencies, import-export flows, and regulatory landscapes empower procurement specialists seeking to forecast demand and lock in favorable supply contracts.

Navigational Shortcut to Comprehensive Research Report

For industry professionals requiring detailed quantitative data, revenue forecasts, and competitive benchmarking, an in-depth market analysis is available in a full research report. This comprehensive study delivers segmented demand projections by application, region, and product grade, enriched with SWOT assessments of leading participants. Readers can download a full brochure to evaluate sample pages, examine forecast methodologies, and access an executive summary.

Organizations interested in procurement planning or strategic investment assessments are encouraged to request a sample extract or inquire about pricing tiers for multi-user licenses. The transactional interface facilitates immediate ordering of the complete report, while subscription options ensure real-time updates on supply-demand dynamics, raw material cost fluctuations, and technological breakthroughs. Access to this resource streamlines competitive intelligence gathering and supports data-driven decision-making across purchasing, R&D, and corporate strategy teams.

Get this Report in Japanese Language: エチレン・ビニル・アセテート市場

Get this Report in Korean Language: 에틸렌 비닐 아세테이트 시장

About Author:

Money Singh is a seasoned content writer with over four years of experience in the market research sector. Her expertise spans various industries, including food and beverages, biotechnology, chemical and materials, defense and aerospace, consumer goods, etc. (https://www.linkedin.com/in/money-singh-590844163)