Increasing Number of Adulteration and Food Fraud Cases Drives the Meat Speciation Testing Market

The meat speciation testing market, by value, is projected to reach USD 2.22 billion by 2022, at a CAGR of 8.2% from 2016. The market growth is driven due to various factors such as regional beliefs to ensure meat species, growth in number of food frauds and recalls, stringent regulatory and labeling mandates, and testing for various certifications requirement.

The years considered for the study are as follows:

Base year: 2015

Forecast period: 2016 to 2022

The objectives of the report

To define, segment, and project the meat speciation testing market, with respect to species, technology, form, and region

To analyze the market structure by identifying various sub-segments of the global meat speciation testing market

To forecast the size of the global meat speciation testing market and its various submarkets with respect to four main regions, namely, North America, Asia-Pacific, Europe, and Rest of the World (RoW)

To provide detailed information regarding crucial factors that are influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

To analyze the opportunities in the market for stakeholders and details of the competitive landscape for market leaders

To forecast the global meat speciation testing market size and its various sub-markets

To project the market size, in terms of value, of each of the segments

To strategically profile key players and comprehensively analyze their market developments and core competencies

To track and analyze competitive developments, such as expansions & investments, acquisitions, and new service offerings & product launches in the meat speciation testing market

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=245489571

The swine segment, by species, accounted for the largest share in the meat speciation testing market in 2015

The market for swine, among other species, was the largest in 2015 and also is the fastest-growing. Increase in number of adulteration of swine meat with horse meat and chicken has led to a desire for increased quality control for meat products. Detection of undisclosed animal species in swine meat products is important to not only protect the consumers from fraud, but also to respect the religious beliefs and cultural preferences of the consumers.

PCR is projected to be the fastest-growing segment by 2022

The market for PCR in the meat speciation testing market is projected to be the fastest-growing from 2016 to 2022. Highest growth in adoption of this technology for meat speciation testing can be attributed to drawbacks of the ELISA (enzyme-linked immunosorbent assay) technology; wherein DNA analysis is conducted by the technology for accurate determination of meat species in products even at 0.1% levels of detection. Another advantage of PCR technology is the automated approach to testing, which provides quick results, and aids the decision making process for product recalls, further distribution of meat products, and other related strategies) of related stakeholders.

The raw form segment is projected to grow at the highest CAGR by 2022

The meat speciation testing market, by form, was dominated by the raw form segment and is also projected to be the fastest-growing segment. This is attributable to the fact that the domestic consumption of meat as well as the meat trade in raw form is very high, due to which the testing of meat in raw form is also the largest as well as the fastest-growing.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=245489571

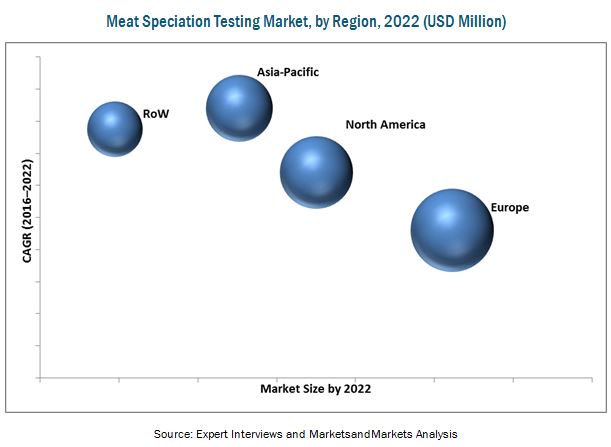

Asia-Pacific is the fastest-growing region in the meat speciation testing market

The meat speciation testing market in the Asia-Pacific region is driven by various rules and regulations implemented by different countries in the region. Food security standards are getting stringent year-on-year to ensure safer supply of food to individuals in local and foreign countries.

This report includes a study of marketing and development strategies, along with the service portfolios of leading companies. It includes the profiles of leading companies such as VWR International LLC (U.S.), Eurofins Scientific SE (Luxemburg), ALS Limited (Australia), Neogen Corporation (U.S.), and LGC Science Group Ltd. (U.K.). Other players that are active in the industry are Genetic ID NA, Inc. (U.S.), International Laboratory Services Ltd. (U.K.), AB Sciex LLC (U.S.), Geneius Laboratories Ltd. (U.K.), and Scientific Analysis Laboratories (U.K.).