Pesticide Inert Ingredients Market - Global Trends, Analysis, Share, Industry Overview, & Forecast to 2023

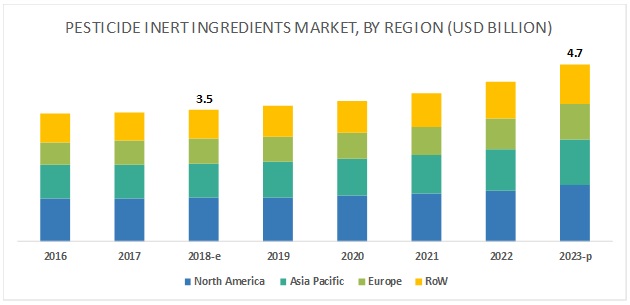

The report "Pesticide Inert Ingredients Market by Type (Emulsifiers, Solvents, and Carriers), Source (Synthetic and Bio-based), Form (Dry and Liquid), Pesticide Type (Herbicides, Insecticides, Fungicides, and Rodenticides), and Region - Global Forecast to 2023", The pesticide inert ingredients market is projected to reach USD 4.7 billion by 2023, from USD 3.5 billion in 2018, at a CAGR of 6.14% during the forecast period. The market is driven by factors such as the increasing demand for specific inert ingredients in pesticide formulation and capability of inert ingredients to improve the efficacy of pesticide application.

Pesticide inert ingredients for the herbicide segment is estimated to have the highest share during the forecast period.

Pesticide inert ingredients are used in herbicide spray solutions to accentuate the emulsifying or other surface modifying properties of liquids. Inert ingredients are mostly present in herbicide treatment solutions with the aim to improve the penetration of active ingredients into plant foliage or to reduce foaming activity of the spray solution. Also, with reference to the herbicides available in the market, the amount of inert ingredients used in herbicide solutions are higher compared to insecticides and fungicides.

High adoption of inert ingredients in the North American region also drives the overall pesticide inert ingredients market. The major use of the formulation of herbicides is in the form of emulsifiers and solvents.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=176580687

The dry segment in terms of forms of pesticide inert ingredients is projected to witness the fastest growth during the forecast period.

Dry inert ingredients are available in various forms such as wettable powders, dust, granules, and talc. The dry form of inert ingredients is majorly used in the formulation of herbicides and rodenticides. Dry forms of pesticides help in attracting rodents in the fields and thus are preferred in agricultural fields for repelling and skilling rodents. The high share of herbicides in the pesticide industry also drives the market for dry inert ingredients.

The Asia Pacific is projected to witness the fastest growth in the inert ingredients market through 2023.

Agriculture is one of the largest industries in the Asia Pacific region, with a large share of farmland and good soil fertility. Moreover, the region is rich in plant diversity due to the wide variations in climate across countries. Even though there is a variation in the agriculture system from basic systems in India to the technically advanced ones in Japan, the agenda of food security is supported by local governments in the Asian countries. The Asia Pacific region is one of the leading consumers of pesticides across the globe, though the region mainly depends on imports of pesticide supply. Since inert ingredients are majorly consumed by pesticide manufacturers at the production facility during the formulation stage, and since countries such as India, Thailand, and Vietnam depend on imports for formulations, the market for inert ingredients is projected to be smaller compared to the Americas and Europe. However, with the increasing establishment of production plants in the Asian countries, the use of inert ingredients along with pesticide application is projected to increase in the future.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=176580687

This report includes a study of development strategies for leading companies. The scope of this report includes a detailed study of major companies such as BASF (Germany), Clariant (Switzerland), DowDuPont (US), Stepan Company (US), and Croda International Plc. (UK). Other players in the market include Eastman Chemicals (US), Solvay S.A. (Belgium), Evonik (Germany), Huntsman Corporation (US), AkzoNobel (The Netherlands), Royal Dutch Shell (The Netherlands), and LyondellBasell Industries (Netherlands).

Recent developments:

In November 2018, Clariant expanded the production capacity of its ethylene oxide (EO) unit in Gendorf, Germany. The expansion resulted in serving customers of various industries such as personal and home care, crop solutions, and industrial application, with EO-based products.

In May 2018, Solvay signed a three-year contract with Beifeng Hengtai Agricultural Development Co., Ltd. to launch a product called AgRho NH4 Protect. It is an eco-friendly liquid surfactant, which can be applied on NPK compound that is the most popular fertilizer in China.

In June 2017, Stepan, through its subsidiary in Mexico, entered into an agreement with BASF Mexicana. This agreement was focused on the acquisition of BASF Mexicana’s surfactant production facility in Ecatepec and a portion of its associated surfactants business.

Key questions addressed by the report:

Which market segments to focus on in the next two to five years for prioritizing efforts and investments?

Which region will have the highest share in the pesticide inert ingredients market?

Which type of pesticide inert ingredients witnesses high demand in each key country market?

What are the trends and factors responsible for influencing the adoption rate of bio-based inert ingredients in key emerging countries?

Which are the key players in the market and how intense is the competition?