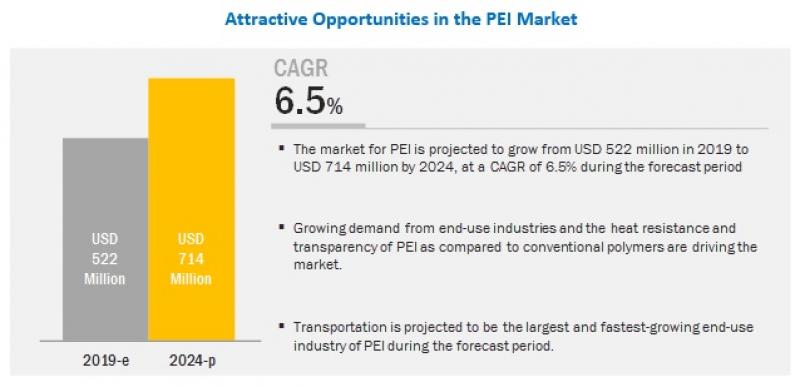

The PEI market size is estimated to grow from USD 522 million in 2019 to USD 714 million by 2024, at a CAGR of 6.5% between 2019 and 2024. The increasing demand from the transportation sector, electrification of vehicles, and replacement of metals and specialty polymers with PEI in heat resistance applications are expected to drive the market.

PEI is a high-performance polymer with both ether links and imide groups in its polymer chain. It is used in high-temperature applications where fast dissipation of heat is essential. Due to its creep resistance, low smoke emission, and flame resistance, the demand for PEI as a thermally conductive plastic has increased significantly. PEI, along with thermally conductive fillers, is a cost-effective solution to metals due to lesser manufacturing steps and joints. PEI is widely used as an alternative to metals in compact electronic gadgets, as it increases the performance of compact electronics by heat dissipation. In addition to the electronics industry, PEI is used in transportation, medical, consumer good, and industrial end-use industries.

Request for Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=264439177

Recent Developments

- SABIC (Saudi Arabia) launched polyetherimide (PEI) film – ULTEM film UTF120. This new product is designed to address the increasing need for high energy density capacitors that can store a large amount of electrical energy for a long period without the loss of charge. This product has application in the electrical & electronics end-use industry. Potential applications of the product include automotive components, electrical compressors, LED lighting, and LCD backlight in electronics and film capacitors in renewable energy.

- RTP Company started a new 86,000 square foot manufacturing facility in Wroclaw, Poland, and this will help the company to support the regional demand and will offer a consistent supply in Europe.

“The reinforced PEI segment is expected to have the highest CAGR during the forecast period.”

Reinforced PEI is formulated to meet the various engineering demands. It can be categorized into two types, namely, glass reinforced and fiber reinforced. Glass reinforced PEI provides greater dimensional stability and improved electrical and mechanical properties while retaining excellent processability. Fiber reinforced PEI is known for its mechanical strength and hence preferred in corrosion protection applications. Fiber reinforced PEI has a lower expansion rate and higher compressive strength and stiffness as compared to glass reinforced PEI. Reinforced PEI also has higher thermal conductivity than unreinforced PEI, which improves the service life of a component. These properties of reinforced PEI are driving the market in different end-use industries.

“Europe to account for the largest share in the PEI market during the forecast period.”

The key countries contributing to the growth of the PEI market in Europe are Germany, France, the UK, Italy, and Spain. Favorable government policies are expected to provide growth opportunities for R&D in the electronics & semiconductor and automotive industries in these countries. The growth in R&D investment in the region is mainly driven by the automotive, information and communications technology (ICT), and healthcare industries, which is expected to boost the demand for PEI in the region.

The leading players in the PEI market are SABIC (Saudi Arabia), RTP Company (US), Ensinger Plastics (Germany), Röchling Group (Germany), Kuraray Europe (Germany) Mitsubishi Chemical Advanced Materials (Japan), Solvay SA (Belgium), (Denmark), and Toray Industries (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst