Australia Ammonia Market Will Grow at Highest Pace owing to Rising Application in Fertilizers Production

Ammonia is an inorganic compound widely used as a building block for the production of fertilizers, plastics, synthetic fibers and other chemicals. It is produced commercially via the Haber process, by combining nitrogen and hydrogen in the presence of a catalyst under high temperature and pressure. Ammonia has important agricultural applications such as use in manufacture of nitrogenous fertilizers like urea, ammonium nitrate and ammonium phosphates. The demand and consumption of nitrogenous fertilizers has been increasing substantially in the agriculture sector of Australia to enhance crop yield. This rising application of ammonia in fertilizers production is expected to drive the growth of Australia ammonia market during the forecast period.

The Global Australia ammonia market is estimated to be valued at US$ 934.85 Million in 2024 and is expected to exhibit a CAGR of 6.4% over the forecast period 2023 to 2030.

Key Takeaways

Key players operating in the Australia ammonia market are Incitec Pivot Limited, Yara International ASA, Orica Limited, and Wesfarmers Chemicals, Energy & Fertilisers. Incitec Pivot Limited is one of the largest producers and distributors of fertilizers and industrial chemicals in Australia. The company operates ammonia plant located in Gibson Island, New South Wales with annual production capacity of 750,000 tonnes.

The demand for ammonia in Australia is projected to grow significantly during the forecast period owing to increasing consumption of nitrogenous fertilizers for crop cultivation. According to the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), the consumption of nitrogenous fertilizers grew by over 3% annually between 2013-14 and 2018-19, reaching 966 kilo tonnes in 2018-19. The demand for ammonia from agricultural sector is anticipated to continue its upward trend over the next few years.

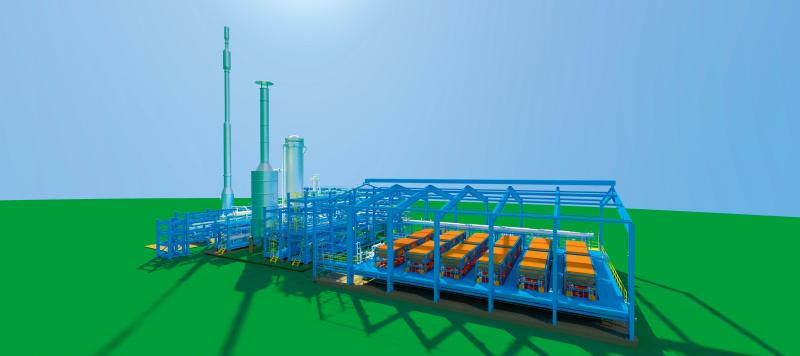

Technological advancements in the Haber process such as improvement in catalyst efficacy and optimization of process parameters have enhanced the energy efficiency of ammonia production. Large scale ammonia producers are continuously focusing on development of low carbon production methods through carbon capture and storage or use of renewable hydrogen to reduce greenhouse gas emissions.

Market Trends

Rising feedstock costs volatility: The prices of natural gas, which is the primary feedstock for commercial production of ammonia, have witnessed high volatility in recent years. This fluctuations in the input prices pose challenges for long term business planning and returns of ammonia producers.

Growing demand for renewable ammonia: With increasing focus on reducing carbon emissions from industrial sector, the demand for green ammonia produced from renewable hydrogen is expected to grow significantly over the coming years. The governments in regions like Europe and Australia are providing policy support for production and use of low carbon ammonia.

Market Opportunities

Use as marine fuel: Ammonia is emerging as a potential zero-carbon marine fuel and few vessels powered with ammonia are anticipated to enter service by 2030. This presents an opportunity for Australia to export green ammonia for international bunkering.

Production of hydrogen: Green ammonia can be produced using renewable hydrogen and later hydrogen can be extracted from ammonia for use in transportation sector. This provides an opportunity to establish an integrated renewable hydrogen economy leveraging Australia's strengths in renewable energy.

Impact of COVID-19 on Australia Ammonia Market growth

The COVID-19 pandemic created widespread disruptions for the Australia ammonia market in 2020 and 2021. Government imposed lockdowns and social distancing policies disrupted supply chains and production facilities across the country. This led to reduced demand from key end-use industries such as agriculture, mining, construction, and fertilizer production. The restrictions on travel and transportation made it difficult for companies to deliver products and receive raw materials on time. As a result, many projects and capital expenditure plans in the ammonia sector were delayed or deferred.

However, with the rollout of vaccination programs and normalization of economic activities, the market is witnessing signs of recovery from 2022. Resurgent demand from agriculture and mining sectors has driven higher ammonia consumption for fertilizer production. The government incentives for investment in renewable energy have also boosted ammonia demand as a clean energy carrier. Several large-scale investment projects in green ammonia/hydrogen are under planning and development phase. It is expected that the market will return to its pre-pandemic growth levels by 2024, aided by support for decarbonization initiatives. Companies are focusing on automation, digitalization and supply chain resilience to mitigate future disruptions. Sustained government support for energy transition and infrastructure development will be critical for Post-COVID growth of the Australia ammonia market over the coming years.

The Australia ammonia market is highly concentrated in regions with large-scale agriculture and mining industries such as Queensland, New South Wales and Western Australia. These states account for over 75% of the country's total ammonia demand owing to their high fertilizer consumption and export-oriented industries. Queensland leads the market with several large-scale production plants located near coal reserves and ports along the coast. Western Australia is also a major market driven by the resources sector including steel production, mineral processing and LNG industries. Tasmania is emerging as the fastest growing regional market for ammonia due to increasing focus on green hydrogen production using hydropower and wind energy.