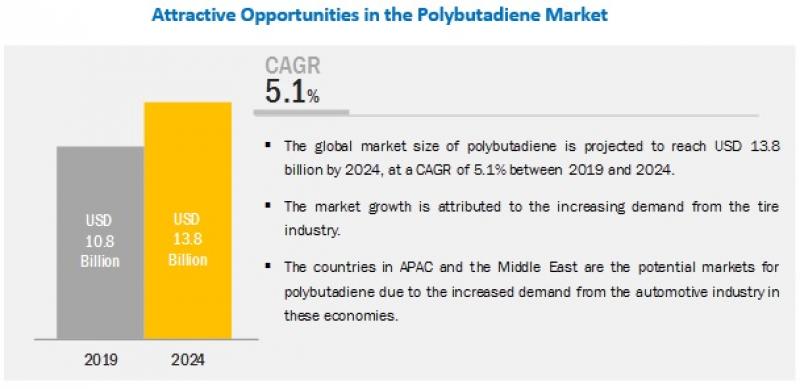

The polybutadiene market size is expected to grow from USD 10.8 billion in 2019 to USD 13.8 billion by 2024, at a CAGR of 5.1% during the forecast period. The polybutadiene market is driven by tire, polymer modification, and industrial rubber manufacturing industries. However, fluctuating raw material prices can hinder the growth of the market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=56692050

The tire industry is expanding due to the growing automotive industry. It accounted for the largest share of the overall polybutadiene market. Furthermore, this segment is estimated to grow significantly during the forecast period. Polybutadiene is widely used in tire manufacturing due to its toughness, good abrasion resistance, cold resistance, high tensile strength, high resilience, tear resistance, and durability.

This research report categorizes the polybutadiene market based on type, application, and region.

Polybutadiene Market, by Types:

- Solid Polybutadiene

- Liquid Polybutadiene

Polybutadiene Market, by Application:

- Tires

- Polymer Modification

- Industrial Rubber Manufacturing

- Chemicals

- Others (sporting goods and footwear)

Polybutadiene Market, by Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Request for sample report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=56692050

Recent Developments

In February 2019, SIBUR decided to launch an investment project aimed at enhancing polybutadiene rubber (Nd-BR) production efficiency at its Voronezh facility (Voronezhsintezkauchuk). The project aims for a large-scale upgrade to boost the operational efficiency of the existing facility and ensure the production of consistently high quality of products. This project will enable SIBUR to produce quality products with improved operational efficiency.

The major players in the polybutadiene market are ARLANXEO (Netherlands), JSR Corporation (Japan), UBE Industries Ltd. (Japan), SABIC (Saudi Arabia), LG Chem Ltd. (South Korea), Versalis SPA (Italy), PJSC SIBUR Holdings (Russia), Sinopec (China), and Kuraray Co. Ltd. (Japan). These companies adopted new product development, joint venture, and expansion as their major business strategies between January 2015 and August 2019 to earn a competitive advantage in the polybutadiene market.