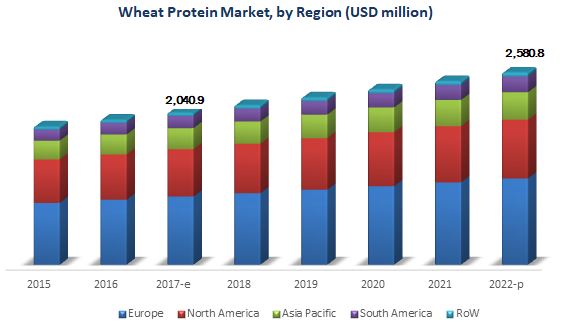

Wheat Protein Market Projected to Reach $2.58 Billion by 2022, at a CAGR of 4.8%

The report "Wheat Protein Market by Product (Wheat Gluten, Wheat Protein Isolate, Textured Wheat Protein, Hydrolyzed Wheat Protein), Application (Bakery, Pet Food, Nutritional Bars, Processed Meat, Meat Analogs), Form (Dry, Liquid), and Region - Global Forecast to 2022", The wheat protein market is estimated to be valued at 2.04 Billion in 2017 and is projected to reach USD 2.58 Billion by 2022, at a CAGR of 4.8% during the forecast period. The market is driven by factors such as a shift in preference for plant-based protein foods, increased demand for meat-free diets, and growing incidence of lactose intolerance.

The years considered for the study are as follows:

Base year: 2016

Estimated year: 2017

Projected year: 2022

Forecast period: 2017–2022

Objectives of the study are as follows:

To define, segment, and project the global wheat protein market size with respect to product, application, form, and key regions

To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

To analyze the opportunities in the market for stakeholders and provide the competitive landscape of the market leaders

To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

To strategically profile the key players and comprehensively analyze their market position and core competencies

To analyze the competitive developments such as expansions & investments, mergers & acquisitions, and new product developments in the wheat protein market

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=67845768

The wheat gluten segment is estimated to account for the largest share of the wheat protein market in 2017

Based on product, the wheat protein market has been segmented into wheat gluten, wheat protein isolate, textured wheat protein, and hydrolyzed wheat protein. The wheat gluten segment is estimated to account for the largest share of the wheat protein market in 2017. It is used in a variety of applications such as bakery products, meat products, pasta, and pet foods. In bakery, the strength of gluten is a key factor in bread baking. It plays an important role as it contributes to the ability of the dough to rise and maintain texture.

The dry form is estimated to account for the largest share of the wheat protein market in 2017

The dry segment is estimated to account for the largest share of the wheat protein market in 2017. They are the most popular forms of wheat protein preferred by manufacturers due to their several benefits, including better stability and ease of handling & better storage conditions.

The bakery & snacks segment, by application, is estimated to accounted for the largest share of the wheat protein market in 2017

The bakery & snacks segment, by application, is estimated to account for the largest share of the wheat protein market in 2017. Presence of major players offering a wide variety of wheat products having applications in bakery is one of the key drivers for the bakery & snacks segment. This shift in consumer preference toward ready-to-eat products has increased the demand for bakery products. In Europe, rise in the aging population and growing health concerns have urged consumers to opt for healthier alternatives such as value-added baked goods.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=67845768

Europe is estimated to account for the largest share of the wheat protein market in 2017

In 2017, Europe is estimated to account for the largest share of the wheat protein market. Factors such as the growing investments by major players in the bakery industry, growing trend of vegan diets, and abundant availability raw materials such as wheat in this region have boosted the demand for wheat protein products in the European market. Furthermore, increased demand for bakery items such as cakes, pastries, and cookies will also drive the demand for wheat protein in the region.

This report includes a study of the marketing and development strategies, along with the product portfolios of the leading companies. It includes the profiles of leading companies such as ADM (US), Cargill (US), Agrana (Austria), MGP Ingredients (US), and Manildra Group (Australia). Other players include Roquette (France), Glico Nutrition (Japan), Crespel & Deiters (Germany), Kröner-Stärke (Germany), Tereos Syral (Germany), CropEnergies (Germany), and Gluten y Almidones Industriales (Mexico).