Rise in Demand for Water Treatment in Industrial Applications Drives the Sodium Hypophosphite Market

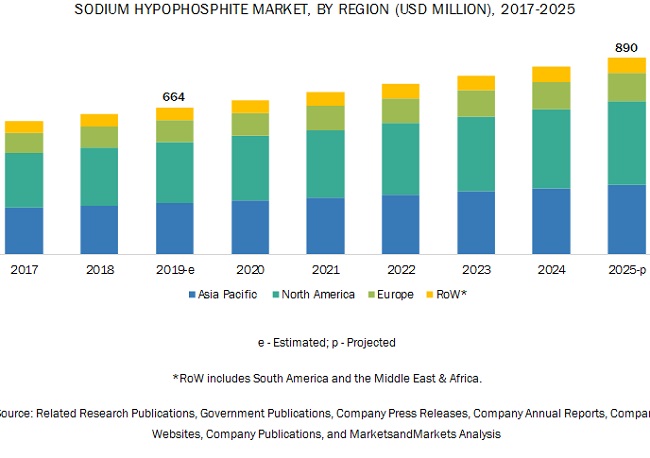

The report "Sodium Hypophosphite Market by Function (Reducing Agents, Catalysts & Stabilizers, Chemical Intermediates), Application (Electroplating, Water Treatment, Chemicals & Pharmaceuticals), Grade (Electrical, Industrial), and Region - Global Forecast to 2025", is estimated at USD 664 million in 2019 and is projected to grow at a CAGR of 5.0% from 2019 to 2025, to reach USD 890 million by 2025 driven by its extensive use in various end-user industries such as automotive, electronics, water treatment, and construction. Massive transformation in the industrial sector has made Asia Pacific a high growth market for sodium hypophosphite manufacturers. The food sector is expected to be an emerging end-use as studies are underway for the multifunctional properties of the chemical in the food industry such as antioxidant, stabilizer, and antimicrobial.

The reducing agent segment is projected to be the fastest-growing in the sodium hypophosphite market during the forecast period.

Sodium hypophosphite acts as a reducing agent for electroless nickel plating application. Electroless nickel plating finds its usage in the electronics and automotive industry. These industries are booming in the emerging Asia Pacific, South America, and the Middle East and African regions. In Asia Pacific, the rise in the number of vehicles in countries such as China, India, and Japan, holds high growth prospects for sodium hypophosphite manufacturers within the automotive industry in the coming years. In water treatment as well, sodium hypophosphite, acts as a reducing agent, to reduce the metal ion content in industrial waste before being discharged in water.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=249801760

The electroplating segment is projected to record the fastest growth during the forecast period.

Sodium hypophosphite finds its usage widely for electroplating application. The automotive and electronics industries utilize the electroless nickel plating application. The corrosion resistance property of electroless nickel plating makes it an ideal choice for both the industries. The Asia Pacific region, a hub of export of electronic products, boasts of high growth prospects for sodium hypophosphite manufacturers in the coming years. Key revenue generating countries in the region include China, among the largest producer of electronics at a global level, Vietnam, Japan, South Korea, Taiwan, and Thailand, the hub of production of hard drives, semiconductor, and integrated circuits.

The electrical grade segment is projected to record the fastest growth during the forecast period.

Sodium hypophosphite has been gaining widespread acceptance across various industrial applications owing to its multifunctional properties. Its application as a reducing agent in electroless nickel plating makes it an ideal product to be used in the automotive, electronics, and chemical industries. It holds high-growth prospects in the Asia Pacific region owing to the expansion of the industrial sector in the region.

The Asia Pacific region is projected to account for the largest market share during the forecast period.

The Asia Pacific sodium hypophosphite market is projected to account for the largest share by 2025. Countries such as China, India, Japan, and South Korea are expected to be key revenue generators during the next few years. Lucrative opportunities lie ahead for sodium hypophosphite manufacturers in the coming years owing to the expansion of the automotive and electronics industry in the region. The region consists of China, a key phosphorous reserve country in the region. Various players in the country are involved in the export of sodium hypophosphite to the Western markets. These include Hubei Xingfa Chemicals Group Co., Ltd. (China), Changshu New-Tech Chemicals Co., Ltd. (China), and Jiangxi Fuerxin Medicine Chemical Co., Ltd. (China).

This report includes a study of marketing and development strategies along with the product portfolios of leading companies in the sodium hypophosphite market. It consists of the profiles of leading companies such as Arkema (France), Solvay S.A. (Belgium), Nippon Chemical Industrial Co., Ltd. (Japan), Sigma-Aldrich (US), Hubei Xingfa Chemicals Group Co., Ltd. (China), Changshu New-Tech Chemicals Co., Ltd. (China), Jiangxi Fuerxin Medicine Chemical Co., Ltd. (China), Jiangsu Kangxiang Industrial Group Co., Ltd. (China), Hubei Lianxing Chemical Co., Ltd. (China), Jiangsu Danai Chemical Co., Ltd. (China), Hubei Sky Lake Chemical Co., Ltd. (China), and Huanggang Quanwang Chemical Co., Ltd. (China).

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=249801760

Key questions addressed by the report:

- What are the new application areas the sodium hypophosphite companies are exploring?

- Which are the key players in the sodium hypophosphite market and how intense is the competition?

- What kind of competitors and stakeholders, such as electronics and automotive companies, would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

- How are the current R&D activities and M&A’s in the sodium hypophosphite market projected to create a disrupting environment in the coming years?

- What will be the level of impact, on the revenues of stakeholders, of the benefits of sodium hypophosphite to different stakeholders‒‒from rising revenue, environmental regulatory compliance, to sustainable profits for the suppliers?