Nutraceutical Excipients Market: Drivers, Restraints, Opportunities, and Challenges

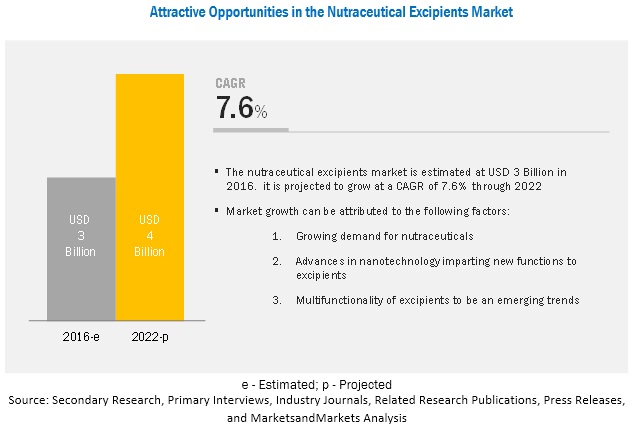

The report "Nutraceutical Excipients Market by Functionality (Fillers & Diluents, Coating Agents, Lubricants, and Flavoring Agents), End Product (Prebiotics, Probiotics, Proteins & Amino Acids, and Vitamins), Form (Dry and Liquid), and Region - Global Forecast to 2022", The nutraceutical excipients market is estimated at USD 2.96 Billion in 2017 and is projected to reach a value of USD 4.27 Billion by 2022, at a CAGR of 7.6%. The market is driven by factors such as the growing demand for nutraceuticals and advances in nanotechnology used in imparting new functions to excipients. The major players in the food industry are investing in research & development activities to expand their excipient product portfolios and attract more consumers by providing innovative products at lower prices.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=247060367

The proteins & amino acids segment accounted for the largest share of the nutraceutical excipients market, by functionality, in 2016.

On the basis of functionality, proteins & amino acids accounted for the largest share of the nutraceutical excipients market in 2016, followed by the omega-3 fatty acids. Excipients are necessary during the manufacturing of protein-based nutraceutical products to avoid protein aggregation. Excipients are also used in the manufacture of amino acid-based nutraceutical products; for instance, in the powder form of the amino acid supplement, they are used for the powder to dissolve easily and give it an acceptable taste.

Fillers & diluents accounted for the largest market share in 2016.

On the basis of type, fillers & diluents accounted for the largest market share in 2016. Fillers are increasingly being used by dietary supplement manufacturers, since the volume of active ingredients in some supplements is extremely low (in micrograms). In such cases, fillers help in bulking up the product. The easy availability and wide acceptance of fillers & diluents to nutraceutical product manufacturers have accelerated the growth of this segment.

Dry excipients accounted for the largest market share among all forms in 2016.

The dry form of nutraceutical excipients accounted for a larger market share, as compared to the liquid form. The popularity of the dry form can be attributed to its cost-effectiveness and convenience in multiple applications. Increase in demand for dry beverage mixes with additional nutrients, including customized mixes, and consumer preference for fortified beverages are fueling the growth of the dry segment in the nutraceutical excipients market.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=247060367

North America dominated the nutraceutical excipients market in 2016.

North America accounted for the largest market share in 2016. The nutraceutical excipients market is consolidated in North America and dominated by a few companies such as DuPont, Kerry, Cargill, and Ingredion. The market for nutraceutical excipients here is mature, and hence, the growth is moderate compared to other regions.

This report includes a study of marketing and development strategies, along with the product portfolios of the leading companies. It includes profiles of leading companies such as Kerry (Ireland), ABF (UK), DuPont (US), Ingredion (US), and Sensient (US), Roquette Frères (France), Meggle (Germany), Hilmar Ingredients (US), JRS Pharma (Germany), Innophos (US), Cargill (US), and IMCD (Netherlands).