Increasing Incidences of False Labeling & Certification Drives the Food Authenticity Market

The report "Food Authenticity Market by Target Testing (Meat Speciation, Country of Origin & Ageing, Adulteration & False Labeling), Technology (PCR-Based, LC-MS/MS, Isotope), Food Tested (Meat, Dairy, Processed Foods), and Region - Global Forecast to 2022", The food authenticity market is projected to reach USD 7.50 Billion by 2022, at a CAGR of 7.6% from 2016 to 2022.

The years considered for the study are as follows:

- Base year – 2015

- Estimated year – 2016

- Projected year – 2022

- Forecast period – 2016 to 2022

The objectives of the report:

- To define, segment, and project the size of the global food authenticity testing market on the basis of target testing, technology, and food tested

- To understand the structure of the food authenticity testing market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of market trends

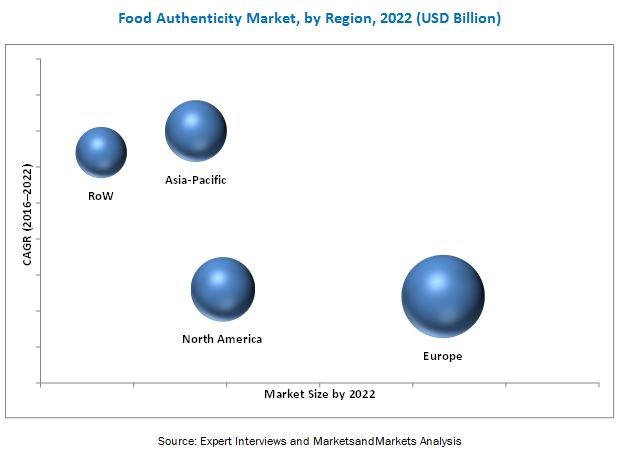

- To project the size of the market and its submarkets, in terms of value, with respect to four regions (along with their respective key countries)–North America, Europe, Asia-Pacific, and the Rest of the World (RoW)

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=157288822

The market is driven by the increased EMA (economically motivated adulterations) due to high competition and increase in incidences of food frauds. Economically Motivated Adulteration (EMA) is a term used when food fraud is committed by way of intentional mixing or substituting food ingredients, for financial gain. In the highly competitive market, concerns of food frauds due to EMA are increasing. EMA is reported as a fairly common food fraud among high-value products.

The adulteration test segment accounted for the largest share in the food authenticity market in 2015

The market for adulteration tests, among all the types of food authenticity, accounted for the largest share in 2015. This increased complexity in the supply chain is creating multiple challenges in the food industry to ensure food authenticity in terms of proper & correct labeling, GMO existence, preventing adulteration, and other economically motivated food frauds. Cutting cost due to competition is influencing adulteration trends. Due to this reason, instances of economically motivated adulteration (EMA) are growing in the market, which is identified as a major health threat for consumers.

PCR-based segment is projected to be the largest and fastest growing segment, by technology

PCR-based technology is found to be the most common, reliable, and widely used technology to ensure the authenticity of food products. Besides the market drivers, significant growth in adoption of this technology for food authenticity testing can be attributed to drawbacks of ELISA (enzyme-linked immunosorbent assay) technology, wherein the technology conducts DNA analysis for accurate determination of adulterant, meat species or GMO in products even at 0.1% levels of detection. PCR-based technology is projected to grow at the highest CAGR from 2016 to 2022.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=157288822

Asia-Pacific is projected to be the fastest-growing region in the food authenticity market

The Asia-Pacific region is projected to be the fastest-growing market through 2022 due to the increasing food safety concerns among the consumers and the growing market for processed food. France is projected to be fastest-growing country in the European region. European countries have recorded many issues related to food authenticity; as a result, stringent policies have been established to ensure complete food authenticity. Food safety authorities in Europe aim to protect consumer health by ensuring the quality of the food supply chain.

This report includes a study of marketing and development strategies, along with the product portfolios of leading companies. It includes the profiles of leading companies such as SGS SA (Switzerland), Intertek Group plc (U.K.), Eurofins Scientific (Luxembourg), ALS Limited (Australia), LGC Science Group Ltd (U.K.), Merieux Nutrisciences Corporation (U.S), Microbac Laboratories Inc. (U.S.), EMSL Analytical Inc. (U.S.), Romer Labs Diagnostic GmbH (Austria), and Genetic ID NA, Inc. (U.S.).