Increasing Demand for Products With Longer Shelf Under Various Conditions Drives the Packaging Testing Market

The packaging testing market, in terms of value, is projected to reach USD 14.64 Billion by 2022, at a CAGR of 12.0% from 2017. Packaging testing includes the testing of various materials such as glass, plastic, paper & paperboard, metal, and others. Growing demand for safe products with a longer shelf-life is driving the demand for packaging testing. This has attributed to the growth of the packaging testing market. The market players are responding to these new opportunities by expanding their global presence and service offerings.

The years considered for the study are as follows:

Base Year – 2016

Estimated Year – 2017

Projected Year – 2022

Forecast Period – 2017 to 2022

The objectives of the study are:

To define, segment, and forecast the size of this market with respect to type, material type, technology, end-use industry, and region

To analyze the market structure by identifying the various subsegments of the packaging testing market

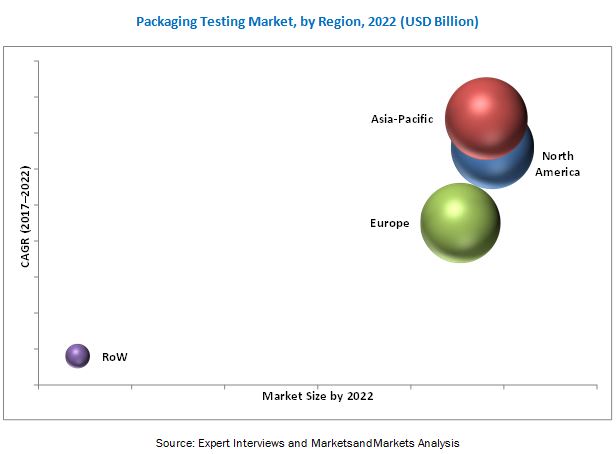

To forecast the size of the packaging testing market and its various submarkets with respect to four main regions, namely, North America, Asia-Pacific, Europe, and the Rest of the World (RoW)

To provide detailed information about the crucial factors that are influencing the growth of the market (drivers, restraints, opportunities, and challenges)

To analyze the opportunities in the market for stakeholders and provide the details of the competitive landscape for market leaders

To strategically profile the key players and comprehensively analyze their market share and core competencies1

To analyze the competitive developments such as expansions & investments, acquisitions, new service & technology launches, agreements, collaborations, and partnerships in the packaging testing market

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=123283179

Paper & paperboard segment projected to grow at the highest CAGR, by material type, from 2017 to 2022

Paper & paperboard packaging is the use of paper or compressed layers of paper/paper pulp to be used for primary, secondary, or tertiary packaging of a product. The market for paper packaging testing is growing due to the increasing use of paper & paperboard for their easy and abundant availability, lower cost, and environment-friendly nature.

Spectroscopy & photometric-based segment projected to grow at the highest CAGR, by technology, from 2017 to 2022

Spectroscopy & photometry is an analytical technique involved in spectral study, which helps in determining the composition and structure of matter. This segment is expected to grow at a high rate primarily due to the reliability of test results, lower turnaround time, and rising demand for spectroscopic techniques in various areas of packaging testing.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=123283179

Food & beverage segment projected to grow at the highest CAGR, by end-use industry, from 2017 to 2022

The rising demand for processed food has fueled the demand for food packaging material used for food & beverage products, thereby generating attractive opportunities for the packaging testing market. Packaging testing services reduce the risk of food contamination and diseases due to faulty packaging of food products. This market is growing since the tested packaging of food & beverage products assures consumers that these meet all the regulatory requirements.

Significant growth for packaging testing is observed in the Asia-Pacific region

The requirement for packaging testing has grown in the region in recent years, owing to an increase in consumer awareness in the Asia-Pacific region regarding the safety of packaging for various products, especially food, healthcare, and cosmetics. The growth in this market is fueled by the economic development in countries such as China and India. China is a potential market for packaging testing due to various factors such as the expanding population, rising disposable income levels, growing export of packaging materials, and increasing consumer demand for convenience foods.

This report includes a study of marketing and development strategies, along with the product portfolios of leading companies. It includes the profiles of leading companies such as SGS S.A. (Switzerland), Bureau Veritas SA (France), Intertek Group Plc. (U.K.), Eurofins Scientific SE (Luxembourg), and TÜV SÜD AG (Germany).