Current Status of Gas Turbines in the Power Sector

Gas turbines play a vital role in providing reliable power to both industrial and utility customers. According to recent studies, gas turbines currently account for over 20% of total global power generation. Their flexibility to ramp up and down quickly makes them well-suited for variable renewable integration and meeting peak demand. Over 300,000 MW of gas turbine capacity has been installed worldwide over the past two decades alone. As this large, globally dispersed gas turbine fleet ages, maintenance, repair and overhaul (MRO) is becoming increasingly important for sustaining optimum performance.

Importance of Effective Planning and Management

Keeping aging gas turbines running smoothly requires careful planning and management of their Gas Turbine MRO In The Power Sector needs. Unplanned downtime can result in lost revenue and higher costs of maintenance. It is essential for plant operators to have a long-term asset management strategy in place. This involves periodic inspections and condition monitoring to catch issues early. It also includes establishing maintenance schedules and stocking critical spare parts. Having qualified technicians and support from OEMs or independent service providers is crucial as well. Proper record-keeping of each turbine's operating history and past repairs helps optimize the maintenance process. With large numbers of units installed across different regions and countries, digitalization is also enabling more efficient remote monitoring, diagnosis and collaboration on repairs.

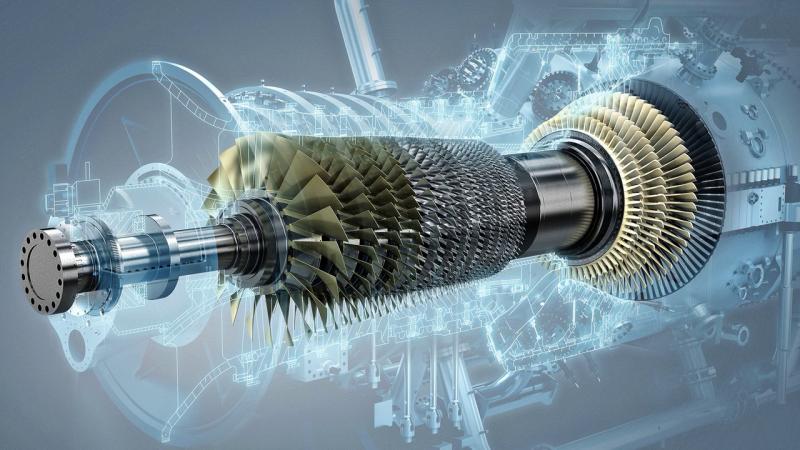

Evolving Risks and Challenges Over Turbine Lifecycles

As gas turbines accumulate operating hours over decades of use, they tend to experience increasing risks of component failures and performance degradation. High-temperature processes inside the combustion chambers and turbines put significant mechanical and thermal stress on materials over time. Factors like variable fuel quality, difficult environments and cyclic loading further accelerate component aging. Common issues include erosion and cracking of blades and nozzles, damage to hot gas path components, bearing wear, leakage in seals and deterioration of coatings. Unexpected breakdowns typically involve high repair costs. Even planned repairs need to be executed efficiently to minimize downtime. Modern turbines are also more complex technologically, requiring specialized skills for their maintenance. Gas turbine operators must continuously evolve their MRO strategies to address these lifecycle risks and challenges.

Advancing Maintenance Technologies and Practices

Advancements in inspection and repair technologies have been enhancing gas turbine MRO. Tools like thermal imaging, vibration monitoring, borescope inspections, ultrasonic testing and gas path analysis help detect issues early before major damage occurs. 3D printing and special additive manufacturing methods are useful for hard-to-find spare parts. Laser welding and cladding extend component lives. Advanced coatings and alloys with improved corrosion and heat resistance increase component change-out intervals. Digital twin applications and AI in predictive maintenance are helping optimize schedules and resource allocation. The expanding use of condition-based and performance-based maintenance contracts by OEMs and independent service providers promotes collaborative, cost-effective solutions tailored to client needs over the long run.

Impact of Energy Transition on the MRO Industry

The large-scale retirement of old coal and nuclear plants is creating new roles for flexible gas turbines in areas like renewable energy integration and grid balancing. At the same time, decarbonization mandates are driving the adoption of low-carbon technologies like hydrogen fuel blending and carbon capture. Gas turbines will need to remain flexible enough to utilize these emerging fuels. Their MRO will have to evolve accordingly to address the challenges of working with new fuel compositions safely and cost-effectively. Independent service providers are also finding new revenue streams in overhauling retired coal plant equipment and converting it for gas turbine applications. On the whole, the energy transition is opening up opportunities as well as necessitating adaptations by the gas turbine MRO industry to fulfill the shifting needs of power generators.

As the global gas turbine installed base continues growing to meet rising power demands, particularly in Asia and other developing economies, maintenance work is projected to rise proportionately. The combined market for gas turbine services inclusive of MRO, repairs, retrofits and upgrades is estimated to surpass $40 billion annually by 2030. Players are expanding their service facilities, tooling capabilities, stocking networks and digital offerings to gain greater market share. Emerging technologies will drive additional aftermarket revenues from performance upgrades, component redesigns and fleet modernization projects. Strategic partnerships for service delivery across wider geographical regions will become more common. Overall, with gas turbines still the technology of choice for flexible, distributed power generation worldwide, their vital maintenance functions ensure this sector remains a major engine of growth for years to come.

Get more insights on Gas Turbine MRO In The Power Sector