Offshore Pipeline Market Will Grow At Highest Pace Owing To Growing Importance Of Cross-Country Oil And Gas Transportation

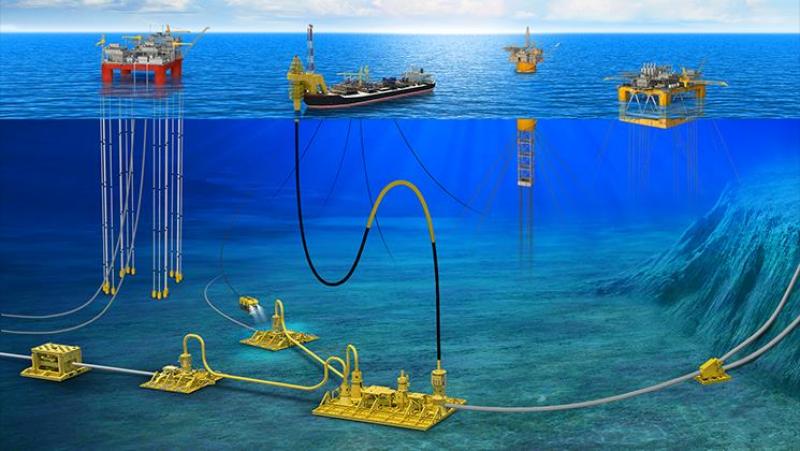

The offshore pipeline market involves the transportation of oil, gas, and refined petroleum products through pipelines laid on or under seabeds. Offshore pipelines help transport hydrocarbons from offshore oil rigs and platforms to onshore refineries and terminals. They reduce operational costs compared to tankers and provide a more reliable supply of energy resources. Key advantages of offshore pipelines include their large carrying capacity and ability to transport fluids over long distances.

The global offshore pipeline market is estimated to be valued at US$ 17.86 billion in 2024 and is expected to exhibit a CAGR of 8.4% over the forecast period of 2024-2030.

Growing emphasis on transportation of oil and gas across national boundaries through pipelines laid underwater as opposed to tankers is expected to drive higher investments in offshore pipelines.

Key Takeaways

Key players operating in the offshore pipeline market are Becton, Dickinson and Company, Pfizer Inc., Novo Nordisk A/S, Gerresheimer AG, B. Braun Medical Inc., Grifols S.A, Baxter International, Inc., Fresenius Kabi AG, Mylan N.V., Bayer AG, F. Hoffmann-La Roche AG, Farmoquimica S.A., Novartis International AG, Eli Lily and Company, União Quìmica FarmacÃautica, Nacional S.A., Cristália, Aspen Pharmacare Holdings Limited, Blau Farmaceutica S.A., Halex Istar IndÃostria, FarmacÃautica SA, Eurofarma, Ache Laboratorios Farmaceuticos SA, Laboratorio Teuto Brasileiro S/A, EMS Pharma, and Hipolabor FarmacÃautica Ltda.

Growing demand for energy resources due to increasing population and industrialization globally is expected to drive higher investments in offshore oil and gas exploration projects and transportation networks. Rapid development of deepwater and ultra-deepwater exploration projects is also boosting needs for new offshore pipelines.

Advancements in pipeline technologies allow offshore pipelines to be built in deeper waters. New materials and pipeline coatings help withstand varied seabed terrains and harsh underwater environments better. 3D seismic survey techniques improve pipeline routing and reduce construction risks.

Market Trends

The trend of retrofitting existing underwater pipelines is gaining traction as it enhances capacities with marginal capital expenditures. Pipeline field life extensions using hydrotesting, sleeving and internal linings are commonly used retrofitting techniques. Rising environmental consciousness is also pushing operators to use pipes with enhanced corrosion resistance and low carbon footprints.

Market Opportunities

Expanding natural gas trade through cross-country pipelines is expected to spur new offshore gas pipeline investments. Growing LNG trade and demand for receiving terminals in new markets also present opportunities for connecting pipelines. Advancing deepwater and ultra-deepwater exploration opens up opportunities for long-distance trunk pipelines.

COVID-19 IMPACT ON OFFSHORE PIPELINE MARKET GROWTH

The outbreak of COVID-19 has impacted the growth of Offshore Pipeline Market Growth . During the initial months of pandemic in 2020, the construction activities related to offshore pipelines were halted completely due to nationwide lockdowns across countries. This led to disruptions in supply chains and temporary halts in ongoing pipeline projects. However, with resumption of activities gradually after lockdowns were eased, the market has started recovering. The demand for oil and gas is also rising with economic activities picking up pace post pandemic. This is supporting the offshore pipeline construction again.

While during 2020 the growth of market was impacted negatively due to construction halts, the demand has bounced back strongly in 2021. The forecast period from 2024 to 2030 also looks positive as oil & gas sector continues to grow steadily. The offshore pipeline infrastructure is being expanded to meet growing energy needs. The investments in new pipeline projects in shallow as well as deepwater reserves have also increased. With COVID-19 under control globally due to extensive vaccination, the offshore construction works are progressing smoothly without interruptions. This will help the market maintain healthy growth rates during the forecast period. However, any future virus waves can again cause temporary disruptions until the situation improves.

GEOGRAPHICAL CONCENTRATION OF OFFSHORE PIPELINE MARKET

In terms of value, the offshore pipeline market is highly concentrated in North America and Europe region. These two regions together accounted for over 60% of global offshore pipeline infrastructure in terms of capital expenditure until pre-COVID times. This is because countries like US, Canada, UK, Norway have seen extensive development of offshore oil & gas reserves over decades. As a result, an extensive network of export and transportation pipelines exists to bring the produced hydrocarbons to onshore processing facilities. Going forward also, these regions will continue to have majority share in global offshore pipeline spend due to growing extraction activities from existing as well as new reserves.

FASTEST GROWING REGION IN OFFSHORE PIPELINE MARKET

The Asia Pacific region has emerged as the fastest growing market for offshore pipelines globally over past few years. This trend is expected to continue even during the forecast period from 2024 to 2030. The key economies driving the growth include India and China. Both countries are ramping up their domestic oil & gas production as well as importing more volumes through LNG terminals. This is boosting demand for new offshore pipelines for transporting fuels from extraction sites as well as import facilities. Several projects are under construction currently which on completion will add substantial pipeline miles in Asia Pacific region. Overall it is estimated that offshore pipeline infrastructure will grow at a CAGR of around 12% in Asia till 2030, fastest among all regions.

Get more insights on Offshore Pipeline Market